#990 PF DUE DATE 2021 FULL#

From their Rock Hill, SC office, SPAN Enterprises works every day toward a better future full of possibilities for every one of their clients. These simplified tax and payroll products have revitalized the process of paying contractors and employees, staying ACA compliant, and e-filing business-related taxes. Additional SPAN Enterprises products include PayWow, ACAWise, 123PayStubs, ExpressExtension, ExpressEFile, and ExpressTa圎xempt. Hundreds of thousands of truckers look to SPAN Enterprises for affordable prices and excellent customer support.

#990 PF DUE DATE 2021 SOFTWARE#

Since 2009, SPAN Enterprises has served trucking industry professionals with innovative cloud-based software solutions including ExpressTruckTax, TruckLogics, and ExpressIFTA.

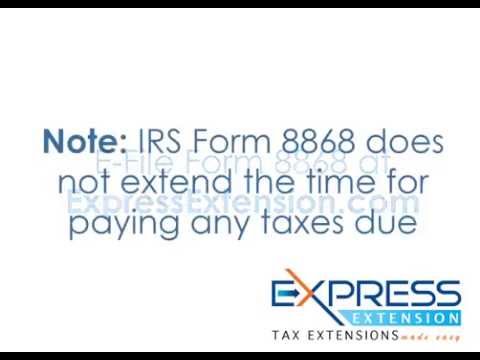

For additional time to file, organizations can file Form 8868 on or before their deadline to request an extension.

Tax-exempt organizations can visit ExpressTa圎 to file Form 990 before the deadline. Meeting IRS e-filing requirements should always be safe, easy, and efficient." When asked about the upcoming Form 990 deadline, SPAN co-founder and CEO, Agie Sundaram, said, "We've developed the best Form 990 filing solution for tax-exempt organizations and we're so proud to support the nonprofit sector during this important deadline. This cloud-based e-filing solution supports Form 990, 990-PF, 990-EZ, and 990-N and makes filing easy for tax-exempt organizations. For calendar year filers, Form 990 is due by May 17, 2021.ĮxpressTa圎xempt is a SPAN Enterprises product supporting 990 series forms for the 2020 tax year. Nonprofit organizations use 990 series forms to report their total assets, financial and charitable activities, governing officers, grants and awards, and other important information. This year, these filing requirements should be met electronically. Nonprofits file a variety of forms determined by their size and function, including Form 990, 990-PF, 990-EZ, and 990-N. This year, in line with the 2019 Taxpayers First Act, the IRS is mandating e-filing for the nonprofit sector. The due date for Form 990-N is the initial return due date, above. Instead of filing an annual return, certain small organizations may file an annual electronic notice, the Form 990-N (e-Postcard). The table above does not reflect the additional day. Nonprofits are required to file 990 series forms every year to provide a financial record for the IRS and the public and retain their tax-exempt status. If a due date falls on a Saturday, Sunday, or legal holiday, the due date is delayed until the next business day. Form 990s must be filed by the 15th day of the fifth month after the end of an exempt organizations accounting period, but they can request filing extensions. ROCK HILL, SC / ACCESSWIRE / / The Form 990 deadline, a major due date for the nonprofit sector, is just a few days away.

0 kommentar(er)

0 kommentar(er)